Property Damage Liability

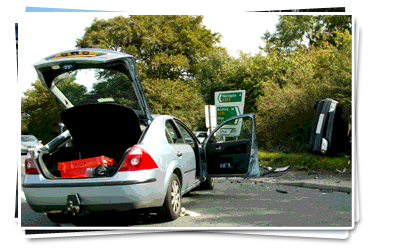

Property Damage Liability is pretty straightforward in the sense that it covers the property damages of the person your vehicle hit, or the vehicle hit by other drivers covered under your insurance policy. In most cases, the property is the victim's vehicle, however it can also consist of a fence, tree, gate, or even a house. In most states, Property Damage Liability is mandatory.

Like Liability Coverage, Property Damage Liability also protects you legally in the case that a lawsuit is filed because of an automobile accident. This type of coverage is not to be confused with Collision and Comprehensive Coverage that cover damages to your own vehicle. Property Damage Liability strictly provides coverage for the vehicle or property that you hit.

I Have Liability. Why Do I Need Property Damage Liability Coverage Too?

Well aside from the obvious reason that your state simply may require you to carry the coverage as a vehicle owner, without Property Damage Liability you are solely responsible for any damage you cause to another person's property, which could possibly mean thousands and thousands of your own money spent to cover the damages and repairs you caused. Carrying too little Property Damage Liability on your car insurance policy could also cause you a major risk if your damages exceed the limit of your policy, thus putting you in the same exact situation as the above, making you personally responsible for the amount of damages that aren't covered, which depending on the accident could put you in a financial hardship. The higher the limit you carry, the more protection you have in a serious matter. It is recommended by The Insurance Information Institute that you carry Property Damage Liability limits of $50,000 or more. Car owners who do not carry Property Damage Liability and reside in a state that requires it will face severe penalties, such as fines, license suspension, and a possible vehicle registration suspension as well.